Pennsylvania Educational Improvement Tax (EITC) Program

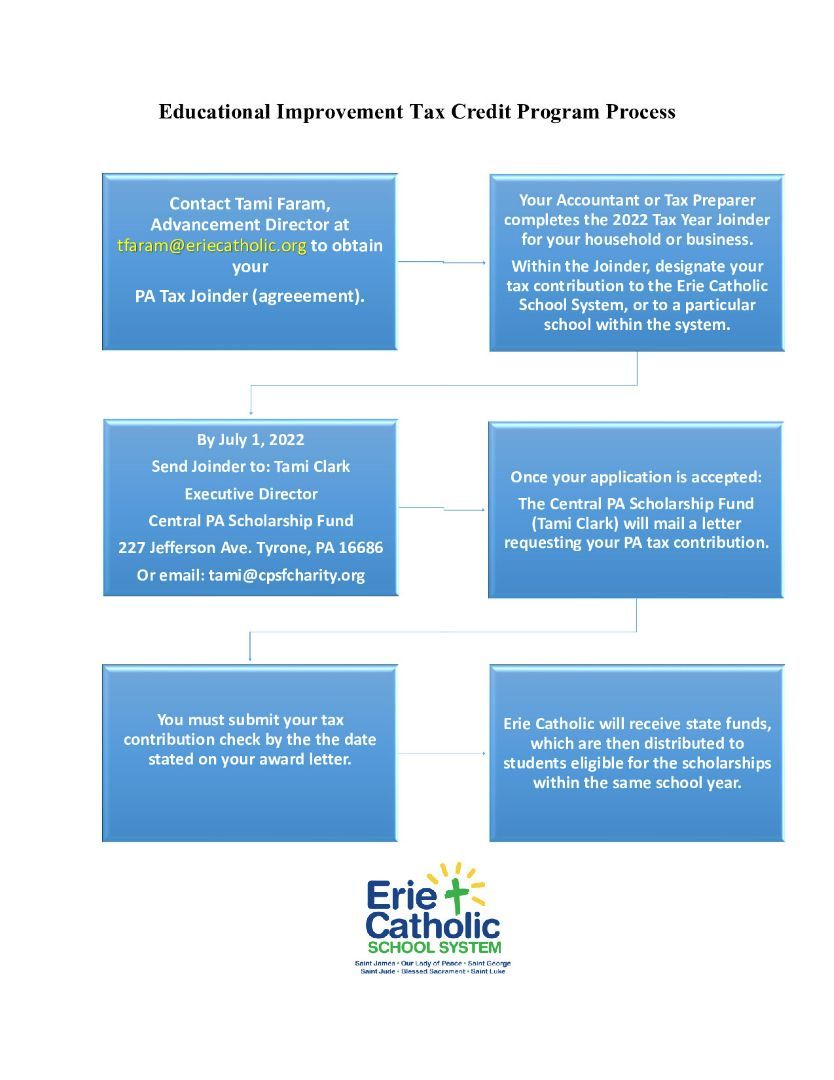

The Educational Improvement Tax Credit Program (EITC) allows businesses to direct 90% of their PA state taxes to support education by funding scholarships at Erie Catholic School System. All donations go directly toward scholarships to qualifying families. This helps families afford Erie Catholic School System education.

Participation has been expanded, to allow individual participation through the Special Purpose Entities. (SPE). Erie Catholic can provide more information to interested individuals and guide you through the process.

For more information:

- Contact Tami Faram, Director of Strategic Advancement.

- Visit the PA EITC Program Website

- Contact the Central Pennsylvania Scholarship Fund.

- Tami Clark – Executive Director, TAMI@CPSFCHARITY.ORG

- Randy Tarpey, CPA – Board President, CentralPAScholarshipFund@gmail.com

Thank you to our current EITC donors:

- Activecare Physical Therapy

- Brugger Funeral Homes & Crematory

- Thomas and Kathleen Burik

- Dr. Christopher and Dr. Caitlin Clark

- Dusckas-Taylor Funeral Home & Cremation Services

- ECCA Payroll+

- Guy and Joyce Euliano

- James Fetzner

- Kurtis and Kathleen Kanne

- Klein Plating Works, Inc.

- Louis & Deborah Montefiori

- Justin and Lisa Panighetti

- Todd M. Powers State Farm Insurance

- PSB Industries, Inc.

- Printing Concepts

- Professional Communications

- Steven and Angela Rinn

- William and Amanda Speros

- Dr. Jennifer and Kennedy Saldanha

- Jim and Christine Toohey

- Jerome and Maureen Wegley

Erie Catholic School System

A School System of The Diocese of Erie

525 E. 34th St.

Erie, PA 16504

p: 814.806.2423 | f: 814.833.6132

© 2025

Erie Catholic School System